Imagine waking up to find Congress has gift-wrapped a single mega-package of tax tweaks, benefit rules, and border spending, plunked a bow on top, and called it the “Big Beautiful Bill.”

Whether you’re clocking in at a café, running an Etsy shop on the side, or mapping out a retirement plan worthy of a spreadsheet nerd’s dreams, this new law is about to leave its fingerprints on your wallet, health-care card, grocery budget, and maybe even that future electric-vehicle purchase. Let’s unwrap what’s inside—perk by pain point—so you can greet the changes with confidence (and a cup of strong coffee).

Quick-Glance Stats

- Date signed: July 4 2025 (South Lawn ceremony)

- Ten-year price tag: ≈ $4.5 trillion in tax cuts, $1 trillion in safety-net cuts, $350 billion in border & defense spending

- Net debt impact (CBO): ≈ $3 trillion through 2034

- First changes felt: Most tax provisions start Jan 1 2026; spending cuts phase in 2026-2029

- Public mood: Early polling runs roughly 2-to-1 against the law

What’s Inside for Everyday Americans

| Provision | Who Wins | Who Loses | Effective |

|---|---|---|---|

| Permanent 2017 rate cuts | Most taxpayers, especially upper-middle & high-income | Federal revenue | 2026 + |

| $40 k SALT cap (5 yrs) | Blue-state homeowners | High earners after 2030 | 2026–2030 |

| “No-tax-on-tips & overtime” (deduction ≤ $25 k) | Hourly & service-industry workers | — | 2026–2028 |

| Child Tax Credit ↑ to $2,200 | Parents | — | 2026 + |

| Estate-tax threshold $15 m / $30 m (couples) | Wealthy families | Treasury | 2026 + |

| 199A pass-through break permanent | LLCs, S-corps | Top-earning owners under new limits | 2026 + |

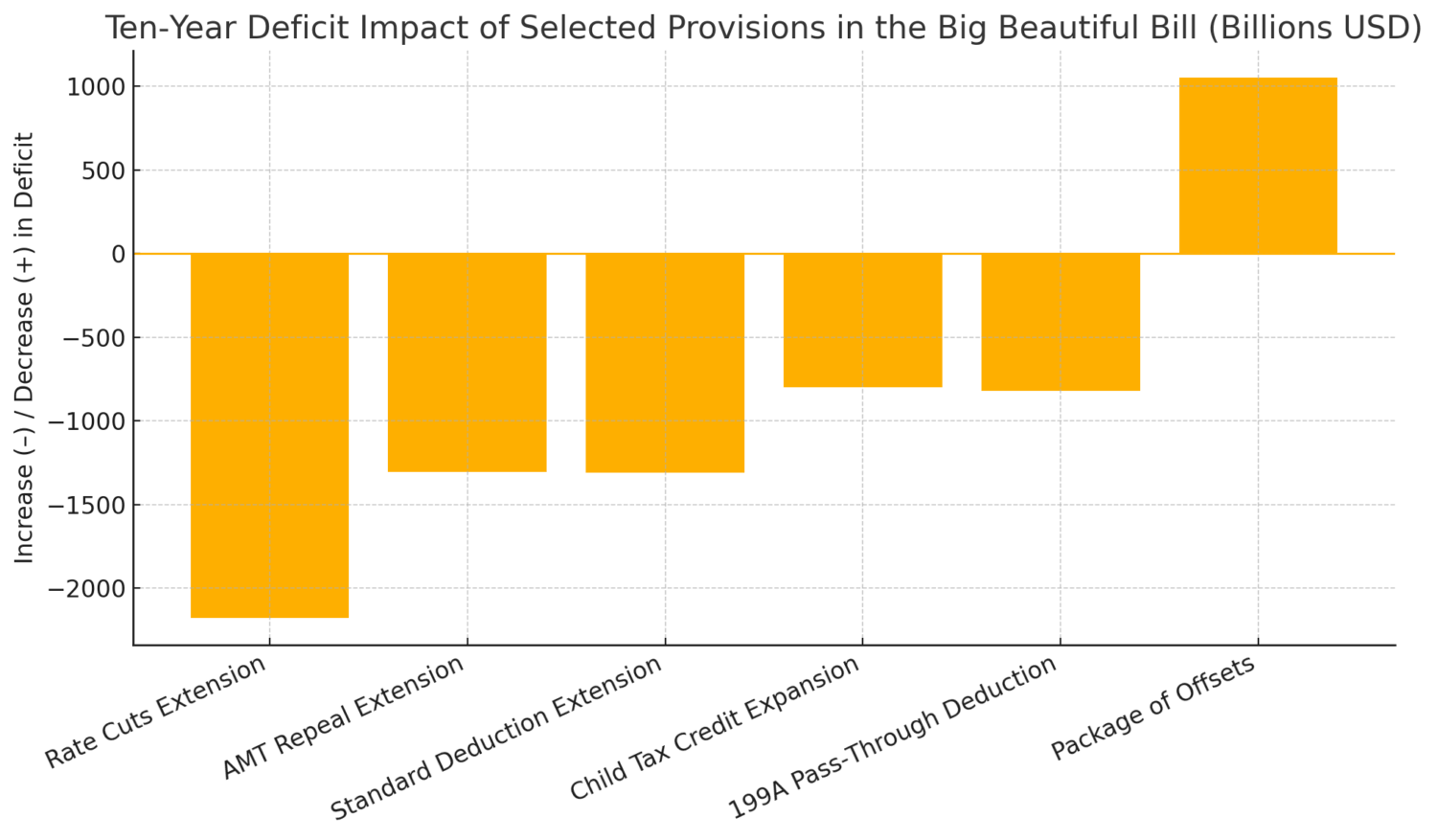

Visualizing the Budget Hit

Ever wonder which line items blow the biggest hole in the deficit? The bar chart below stacks the winners and offsets side-by-side so you can see—in vivid color—how extensions of the 2017 tax cuts dwarf the bill’s pay-fors.

Tax-Cut Deep-Dive

Middle-income households (around $70 k) should see about $1,100 less in annual federal taxes once the preserved brackets and boosted Child Tax Credit kick in. Low-income families pick up only $100-$200 of relief, a sliver compared with what they stand to lose in safety-net trims (next section). At the top of the ladder, the top 1 % pockets roughly $60 k a year thanks to the SALT bump, estate-tax shelter, and capital-gain tweaks. Small-business owners score permanent 199A deductions and 100 % bonus depreciation through 2029.

The Spending-Cut Side

Medicaid & SNAP

- Medicaid work requirements apply to able-bodied adults 18-64, with recertification every six months.

- Projected effect: about 17 million fewer enrollees by 2034.

- SNAP raises the work-requirement age to 64 and shifts some benefit costs to states, trimming benefits for roughly 4.7 million participants.

Student Loans

- The SAVE income-driven plan is scrapped in favor of a flat 10 % repayment cap.

- Grad-PLUS loans disappear; undergrad loan ceilings rise.

- Ten-year savings: about $295 billion.

Climate & Energy Rollbacks

- Electric-vehicle credits end Sept 30 2025.

- Residential energy-efficiency credits are repealed.

- Net deficit reduction from climate rollbacks: $571 billion.

Border & Security Spend

- $46.5 billion for new wall construction and ports-of-entry upgrades.

- $45 billion for 100 k detention beds plus 10 k new ICE agents.

- $100 asylum-application fee (minimum) nationwide.

Big Winners & Not-So-Lucky Losers

- Clear winners: High-income households, small-business owners, border-state contractors, seniors claiming the new “senior standard deduction.”

- Mixed bag: Middle-class families (modest tax cut vs. higher future debt), hourly workers (tip deduction ends 2028).

- On the losing end: Low-income Americans relying on Medicaid/SNAP, aspiring EV buyers after 2025, deficit hawks.

Ten Practical To-Dos

- Re-check your 2026 withholding when the IRS issues new tables.

- Itemize or standard-deduct? SALT relief is temporary—run the numbers.

- Track tip income anyway; payroll and state taxes still apply.

- Medicaid recipients: Set calendar alerts for twice-a-year recertification.

- Business owners: Max out 100 % bonus depreciation before 2029 sunset.

- EV shoppers: Buy before Sept 30 2025 for the $7,500 credit.

- College planners: Compare private-loan options early—Grad-PLUS is gone.

- Bond investors: Rising Treasury issuance may boost yields—rebalance.

- Bunch charitable giving to leverage the revived non-itemizer deduction.

- Watch state tax reactions; legislatures may tweak codes to offset federal shifts.

Politics & the Road Ahead

Republicans hail the bill as a growth engine; Democrats dub it “Robin Hood in reverse.” Expect technical-correction bills and state-level legal fights over work requirements, asylum fees, and Medicaid funding. Early polls suggest the public remains skeptical—setting the stage for a bruising 2026 mid-term battle.

Bottom Line

The Big Beautiful Bill touches nearly every household in America. Middle-class filers get a modest tax cut; lower-income Americans face tighter safety nets; high earners and many businesses collect the lion’s share of benefits. Whether future growth offsets the $3 trillion debt addition is the question voters—and markets—will debate for the rest of the decade.

R. A. Goldston, CPA at Large

Disclaimer: Figures reflect Congressional Budget Office and Committee for a Responsible Federal Budget estimates released July 2025. Consult a qualified tax professional for personalized advice.

Previous post

Previous post