How Taxes at the Border Shape Your Wallet

Introduction: The Silent Tax That Hits Your Grocery Cart

If you’ve ever noticed the price of peanut butter suddenly go up and blamed the weather or your neighborhood store, here’s a fun twist: it might be global politics. Tariffs are like the cover charges of international trade—except instead of just annoying you at the club entrance, they can mess with your paycheck, your purchases, and your economic future.

They’re dry on paper, but tariffs are economic soap operas wrapped in tax policy. They’ve started wars, ended careers, and kept entire industries afloat. Whether you’re into side hustles, budget hacks, or running a full-on small business, you should absolutely know what tariffs are and why they’re lurking behind the price tags of everyday life.

So buckle up. We’re going on a guided tour of trade taxes: past, present, and how they sneak into your wallet.

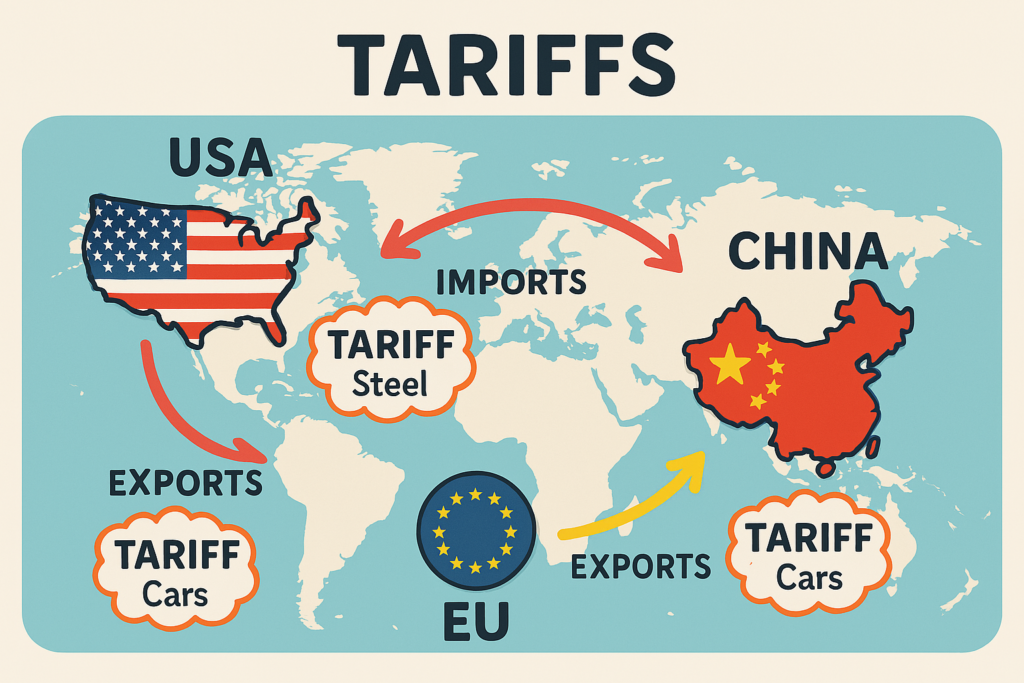

1. What the Heck Are Tariffs, Anyway?

Let’s clear the smoke: a tariff is a tax placed on goods when they cross a border. That’s it. A country imposes a tariff to either make imported goods more expensive (so people buy local) or raise money (because taxes gotta tax).

There are two main types:

- Ad Valorem Tariff: This is a percentage of the item’s value. For example, 10% on a $1,000 refrigerator = $100.

- Specific Tariff: A fixed fee per unit—say, $5 per shirt, no matter if it’s Prada or Walmart-grade.

There’s also the retaliatory tariff, which is basically a country saying, “Oh, you tax my cheese? Cool, I’ll tax your wine.”

Who Really Pays?

Companies importing goods technically pay the tariff, but they usually pass that cost right along to you. So when tariffs go up, so do prices on everything from iPhones to avocados.

2. A Brief and Bumpy History of Tariffs (1900s to Now)

Tariffs have a long history in America—some would say we were raised on tariffs. In fact, before the federal income tax showed up in 1913, tariffs were a primary source of government revenue.

Early 1900s: America First, Version 1.0

- High tariffs were the norm, protecting U.S. manufacturing.

- The Fordney–McCumber Tariff of 1922 jacked up duties to record highs.

- This “keep it American” approach had short-term benefits, but…then came Smoot-Hawley.

1930: The Smoot-Hawley Tariff Debacle

- This infamous law raised tariffs on over 20,000 goods.

- It backfired spectacularly. Other countries retaliated.

- World trade fell by 60%. The Great Depression deepened.

- Economists still use it as a “what NOT to do” case study.

Post-WWII: Global Trade Therapy

- The U.S. helped launch GATT (General Agreement on Tariffs and Trade), aiming to reduce barriers.

- Over the next 50 years, global tariffs fell dramatically.

- Enter the World Trade Organization (WTO) in 1995, making rules-based trade the new normal.

1990s–2000s: Free Trade Bonanza

- NAFTA (1994) eliminated tariffs between the U.S., Mexico, and Canada.

- China joined the WTO in 2001, unleashing an export boom.

- Critics pointed to manufacturing job losses in the U.S., especially in the Rust Belt.

3. How Tariffs Affect the Economy

Here’s where it gets juicy. Tariffs don’t just make imports pricier—they ripple through the economy like a caffeine-fueled toddler in a quiet room.

Imports and Exports Get Shaky

- Importers: Their costs go up. Some absorb it, most pass it on.

- Exporters: Face retaliation or supply chain issues, reducing competitiveness abroad.

Inflation: The Uninvited Guest

Tariffs often spark inflation. If you tariff foreign steel, the cost of cars, buildings, and bridges might rise. It’s like charging extra for flour and wondering why bread costs more.

Jobs: Save Some, Lose Others

- Tariffs can protect domestic jobs—in steel, for instance.

- But downstream industries (like construction or car makers) may suffer job losses due to higher input costs.

Small Biz and Consumers Take the Hit

Big corporations might shift production or negotiate. Small businesses? They often have to eat the cost or raise prices. Consumers feel the squeeze either way.

4. What’s Going On with Tariffs Today?

If tariffs were quiet background noise in the 2000s, the 2010s turned up the volume to full Metallica.

The U.S.–China Trade War (2018–2020)

- The Trump administration levied tariffs on over $360 billion in Chinese goods.

- China responded in kind—affecting soybeans, cars, electronics, and more.

- U.S. farmers needed bailouts; some industries relocated or shuttered.

Current State of Play (2024–2025)

- Many Trump-era tariffs are still in place.

- Biden’s administration has reviewed, adjusted, and re-justified several.

- There’s pressure to reduce reliance on China—cue new tariffs on tech, rare earth metals, and EV batteries.

- Labor unions often support tariffs; globalist economists usually don’t. It’s a political hot potato.

Recent Focus Areas:

- Steel and Aluminum: National security argument = tariffs remain.

- Solar Panels & EVs: Tariffs aim to support domestic clean energy.

- Medical Supplies: COVID revealed supply chain risks—tariffs now target strategic independence.

5. Tariffs Around the World

America isn’t the only one playing this game. Tariffs are used globally, often strategically.

European Union (EU)

- Generally pro-free trade but will retaliate when needed.

- Tariffs on U.S. bourbon, Harley-Davidsons, and jeans came in response to Trump’s metals tariffs.

- Protects agricultural sectors (French wine, Italian cheese) with serious zeal.

China

- Uses tariffs and non-tariff barriers (like quality standards) as leverage.

- Retaliated hard during the U.S. trade war.

- Has lowered some tariffs for developing nations to gain influence.

Developing Nations

- Use tariffs to nurture local industries (infant industry theory).

- Critics say this slows innovation; supporters say it’s economic survival.

World Trade Organization (WTO)

- The WTO should regulate disputes, but enforcement has weakened.

- U.S. and others have bypassed it, weakening multilateral trade.

6. Tariffs and You: What’s the Bottom Line?

Let’s bring this home. You, dear reader, are not importing steel beams or negotiating soybean exports. So why should you care?

1. You’re Paying More Than You Think

- Higher prices for phones, clothes, food, cars—those costs trickle down.

- Tariffs are an invisible tax with visible effects.

2. Side Hustlers and Small Business Owners Beware

- Selling imported goods? You’re vulnerable.

- Building things with foreign parts? Your costs might rise unexpectedly.

- Domestic suppliers might raise prices too, knowing the competition is blocked.

3. Tariffs Can Shift Jobs—and Neighborhoods

- Protectionist policies may boost local factories.

- But they can also prompt automation, layoffs in related industries, or foreign retaliation.

4. Elections and Trade Policy

- Candidates often campaign on “fair trade” but define it differently.

- Some voters want cheaper goods. Others want more local jobs.

- Know what you’re voting for when “trade” is mentioned on a platform.

Conclusion: The Fiscal Means Take

Tariffs aren’t inherently evil or amazing—they’re tools. Sometimes a good idea, sometimes a flaming dumpster of unintended consequences.

For anyone managing a household budget, a side hustle, or a full-blown business, tariffs are worth understanding. They’re baked into your costs, even when they’re invisible.

The next time someone says “globalization” and your eyes start to glaze over, remember: the price of your toaster might just depend on it. And that, my fiscally curious friend, is why knowing about tariffs pays.

R. A. Goldston, CPA at Large

Previous post

Previous post

Next post

Next post